Life Insurance in and around Longview

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

The average cost of funerals in the U.S. is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your family to pay for your funeral as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help the people you love afford funeral arrangements and not end up with large debts.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Put Those Worries To Rest

And State Farm Agent Dalton Lipsey is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

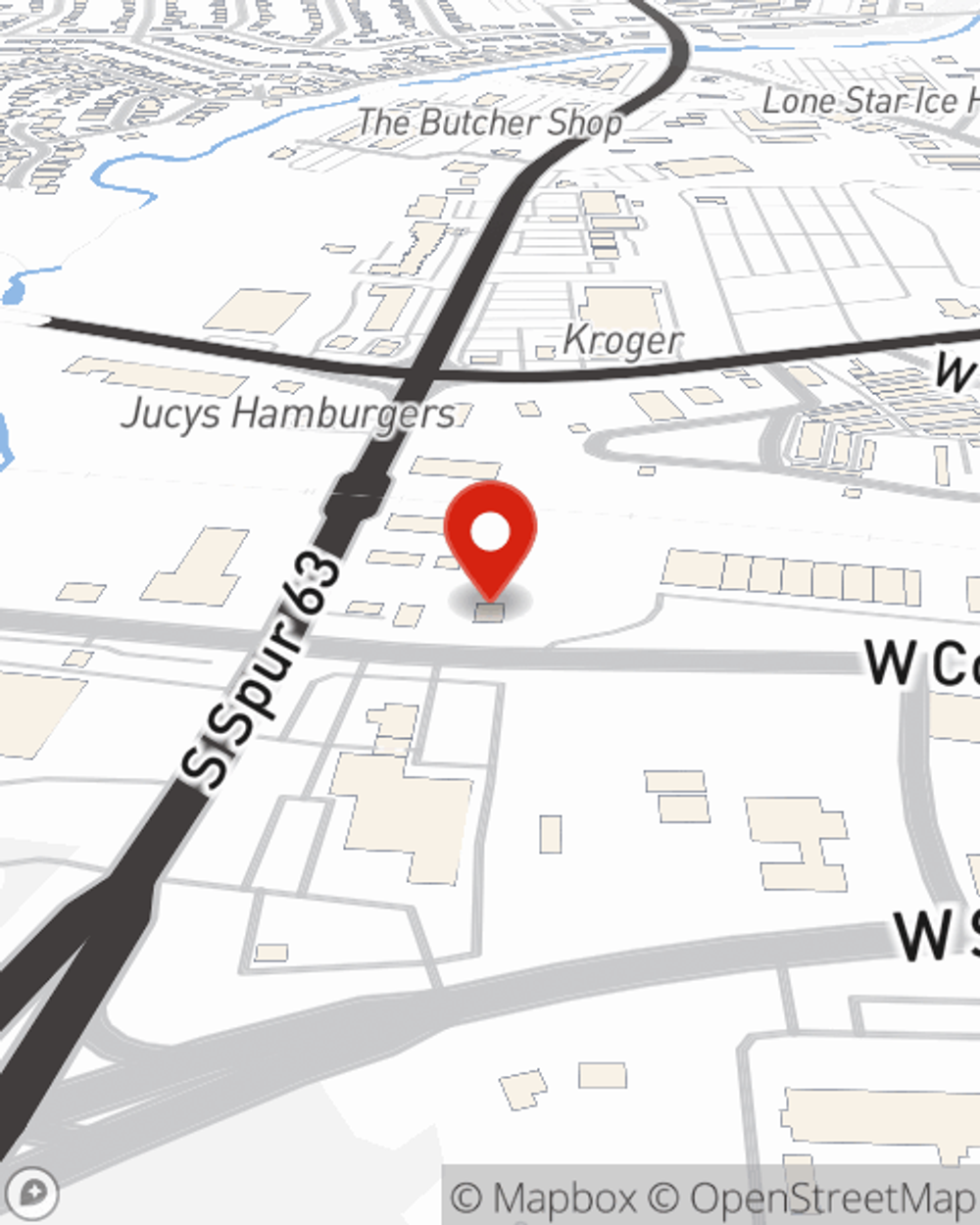

Interested in learning more about what State Farm can do for you? Visit agent Dalton Lipsey today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Dalton at (903) 758-8325 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Dalton Lipsey

State Farm® Insurance AgentSimple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.